Multimodal KYC solutions backed by Biometrics for strong Authentication

Azimut’s Know Your Customer solution is setting new standards in the space of compliance, KYC and ID verification. Our end-to-end solution helps your business, legal, regulatory and compliance teams to efficiently perform all necessary KYC and AML checks on any type of customers, merging all components of onboarding within a single suite.

KYC’s getting harder, but it’s necessary

to avoid an onboarding crisis

Customer Onboarding & Screening

Azimut’s KYC solutions accelerates your internal due diligence process and enables automation of compliance regulations.

Seed up customer onboarding and take immediate action without a backlog of false positives. Solution offers real-time notifications and alerts of changes in new risks.

We offer a range of integration options from fully managed services to API integration and single point solutions.

Enterprise Document

Collection Solution

Azimut’s provides a wide range of secure options for customers to provide information to organizations for KYC. This includes highly secure iOS & Android Mobile Apps, Web Browser Portals, Upload Portals and Rest API’s.

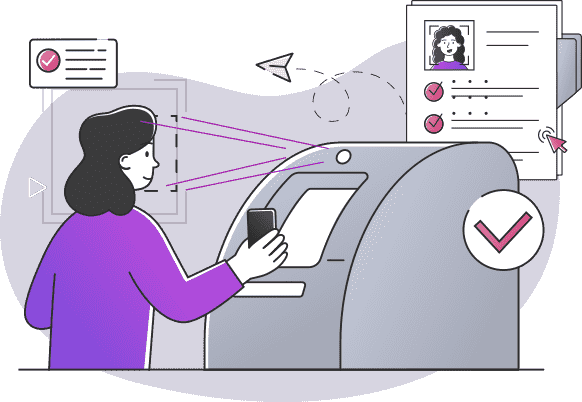

Another innovative way for businesses to ensure fast collection of such documents is through self-service deployments. The platform fully supports facial, Iris and fingerprint biometrics, providing greater accuracy and more flexibility than a single form of biometric. ViaOS also offers native support of 1:1 matching and 1: N matching

Through our sophisticated rules engine, we enable regulators from telecom, government, banking or any other industry to design custom specific user journeys, only requesting the documents that are truly needed.

.

Data Extraction & Assessment

Individual customers’ IDs, securely uploaded via mobile app or web portal, are screened and verified. We extract these details through Optical Character Recognition (OCR) and Artificial Intelligence (AI). Our KYC solution integrates with your central database and can flag any new potential customers against anti-money laundering.

Reporting & Analysis

KYC due diligence policies are becoming much more important globally. The objective of KYC due diligence reporting is to establish verifiable means by which the integrity of individuals can be assessed.

With Know Your Customer, compliance teams can easily and quickly create a variety of customized reports, including regulatory, internal, and external reports, on-demand, and in real-time.

Through an extremely intuitive user interface, our system showcases key statistics about compliance.

SIM Registration

Global safety & government requirements have confronted many telecom companies with a new challenge. Due to increased safety regulations, governmental bodies demand transparent customer relationships.

The Azimut SIM card registration suite allows easy and secure collection of demographic information as well as biometric data to ensure KYC requirements.

The system allows real-time linking of a mobile SIM number with its owner after all validation and forgery-proof biometrics checks. On check-out you can take vital customer feedback via SMS or email to ensure customer satisfaction.

Age Verification

Azimut’s Document Verification extracts the date of birth from a presented ID. It primarily enables a business to verify that the person making a purchase, is not less than a specified age.

Adding biometrics and liveness detection also gives you the power to compare the customer with a presented photo ID. This provides you with a score based on how similar the two faces are. This ensures that minors aren’t simply presenting a parent’s identity document.

Driver Registration

Verifying renters and new license applicants can be expensive.

Our driver verification is simple, quick and secure. All the user needs to do is take a picture of their driver’s license. Our machine learning powered algorithms then analyze it, and detect whether it’s genuine or fraudulent. Liveness detection also gives you the power to compare the customer with a presented photo ID.

Our OCR autofill feature extracts data from the user’s driver’s license and uses it to automatically prefill the sign up form for them

Fraud Detection

In today’s hi-tech age, identity fraud is a major threat! It’s a risk to revenue, business, brand and to customer trust.

But the right identity verification solution you can now defend against fraud and identity theft risk. Azimut’s identity checks are deployed at the very start of the customer journey ensuring high risk touchpoints are secured.

National Identity Card Integration with KYC System

Azimut’s KYC suite can also integrate with the biometric National Registration and National Identity database to perform Know Your Customer (KYC) validations. Such integrations improve account linkages, and credit rating accuracy which manages risks, combats identity theft and prevents money laundering and financial fraud.

More Than Two Million Happy Customers

Globally more than 2 million people pass through our customer

experience solutions, daily.