In today’s fast-paced world, technological advancements have revolutionized various sectors, including the banking and finance industry. One such innovation that has transformed the way banking services are offered is Cash Deposit Machines (CDMs). CDMs have become game-changers, providing customers with enhanced convenience and efficiency in cash handling.

This article will delve into what CDMs are, how they work, and the benefits they bring to the banking and finance industry.

- CDM Definition

- Why CDMs in Banking Industry?

- Enhanced Customer Experience

- Cash Deposit Machines (CDMs) Beyond Traditional Deposits

- The Anatomy of a CDM (How CDM Machine Works)

- The Future of Cash Deposit Machines

CDM Definition

CDM is short for Cash Deposit Machine and performs the opposite function of an ATM or Automated Teller Machine; CDM machine accepts deposits against a customer’s bank account instead of dispensing cash from the same account.

CDMs are freestanding kiosks that may be wall-mounted as well, and they have a very similar interface and user experience to more recent iterations of the ATM.

The Origin of CDMs

Technically, the first cash deposit machine in the world was introduced and deployed in 1989, but it wasn’t until the 2000s that it became popular in regions like the United States.

It became popular because customers wanted easy access to deposit cash as conveniently as they could withdraw it using ATMs. The convenience of a 24/7 access kiosk drove the success of both the ATM and the CDM.

Why CDMs in the Banking Industry?

Another reason for the inception of the idea of a kiosk that accepts ATM deposits was to optimize bank branch operations. You see, most transactions in a bank branch are daily deposits, be it cash or check. Manually processing these deposits introduces a few problems:

- The number one concern with manual cash management is the risk of theft, both internal and external.

- Another big problem with manually processing these deposits is that human tellers are prone to error, no matter how well-trained they may be.

- Safety concerns and risks are associated with physically transporting the cash safely to the vaults.

- These in-person deposits have an adverse effect on productivity as well. Long, manual processes are time-consuming and cumbersome for employees without a positive impact on revenue.

These were the main reasons for the need for an automated system for accepting deposits. This bred the Cash Deposit Machine and, later, a similar kiosk that also accepted checks.

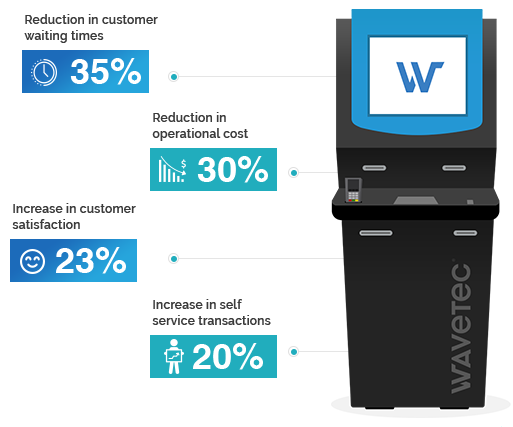

Enhanced Customer Experience

The initial deployments of CDMs were met with negative critique from naysayers, but soon, people realized the undeniable benefits of the technology. With banks and financial institutes able to move more transactions from branches to kiosks, customers would no longer have to enter branches for everyday tasks like making a deposit or withdrawing cash. The ability to install freestanding kiosks in public locations unlocked scenarios that were previously impossible:

- Bank customers could access basic financial services 24/7 through CDMs since they aren’t limited by branch operational hours.

- Kiosks rarely require customers to form queues since their customer service times are so short, and they aren’t limited to any specific operation hours within a day.

- Physical branches became less crowded for transactions that required human tellers who also experienced job enrichment since they weren’t processing deposits all day long.

Cash Deposit Machines (CDMs) Beyond Traditional Deposits

Beyond deposits, modern banking kiosks can achieve a lot more and provide immense value to customers and banks. Since 1989, CDMs have come a long way, and bank kiosks can now be programmed and configured to perform a number of different workflows:

- Cash deposits

- Check deposits

- Bill payments

- Debit/credit card dispensing

- New customer registration & onboarding

Some more advanced kiosks also provide services such as paying income taxes and applying for loans.

The Anatomy of a CDM (How CDM Machine Works)

Many self-service solutions providers will allow you to configure a banking kiosk that works for you and your use cases. Here, we have a standard example of a modern Cash Deposit Machine.

As standard options, CDMs will have a touchscreen interface, some form of biometric data collector, a cash vault or bag, and most importantly, a cash acceptor. Other options include a card reader, check scanner, document scanner, etc.

Biometrics

The most common biometric sensors on CDMs are fingerprint sensors, facial recognition, and liveness detection cameras. These sensors serve the purpose of identity verification when accessing one’s account or onboarding new customers.

Interface

Most modern self-service kiosks have large multi-touch displays to enable an easy and familiar user interface, similar to other touch-based devices like smartphones and tablets. This makes the kiosk easy for all age groups, even those unfamiliar with smartphones and tablets.

Currency Storage

These kiosks have vaults or bags that store deposited cash, similar to ATMs. The capacities of these vaults differ and can be customized based on a financial institution’s requirements.

Cash Acceptor

The cash acceptor is the most important and definitive module of a CDM, which gives it purpose. These modules can be differentiated by their cash-in capacity, i.e., bunch or bulk. Bunch deposits are limited to 50 notes at a time, while bulk deposits can accept up to 500 notes at once.

Additional Capabilities

CDMs aren’t limited to the capabilities mentioned above and can be equipped with additional modules to increase their capability exponentially:

- Cash recyclers, so they can both accept and dispense cash

- Escrow function, so cash isn’t stuck in case of an outage

- Check acceptor, to accept banker’s checks

- Document scanner to scan customer ID in case of new registration or identity verification

- Card dispenser to issue and dispense debit cards to new customers

- Card acceptor, to accept payments against bills or other transactions

The Future of Cash Deposit Machines

According to our trend analysis within the banking and self-service industries, CDMs have become a staple in North American and European markets and are slowly making their way over to developing markets. CDMs are not only convenient, but they offer a means to increase financial inclusion rates in regions with a higher number of unbanked individuals and a small network of bank branches.

The ease of access to this technology for online banks and customers makes this an easy solution to test out services in regions with less financial coverage. Also, digital transformation with self-service is the future for many industries, including telecom, retail, and quick-service restaurants.

Contact our self-service experts today to configure the perfect solution for your financial institution or banking needs.

-

Cardless Cash Deposits with CQuick

-

Reallocating Branch Real Estate to Maximise Efficiency

-

Cash Automation Trends in Developing Regions

Case Studies:

Co-operative Bank of Kenya

Kenya has witnessed a rapid increase in financial inclusion, with a significant portion of the population gaining access to banking services. Co-operative Bank of Kenya strategically deployed Cash Deposit Machines (CDMs) at various branches and other accessible locations.

These machines allowed customers to deposit cash directly into their accounts, eliminating the need for human intervention and reducing transaction times significantly. The implementation also included a comprehensive communication campaign to educate customers about the benefits and usage of CDMs.

The primary objective of introducing cash deposit machines (CDMs) in Kenya was to enhance customer experience by providing a faster, more convenient, and efficient method for cash deposits.

By leveraging technology, banks aimed to reduce transaction times, eliminate long queues, and empower customers with greater control over their financial transactions.

Frequently Asked Questions:

What does CDM stand for in banking?

In banking and the financial services industry, CDM stands for Cash Deposit Machine.

What’s the difference between a CDM and an ATM?

As opposed to an ATM that only dispenses cash, a CDM performs the opposite function, i.e., it accepts cash deposits into a specified bank account.

Does a CDM need a card to operate?

Depending on the manufacturer, a CDM may or may not require a CDM card to operate.

What is a CDM deposit?

A CDM deposit is a cash deposit performed using a self-service kiosk called a Cash Deposit Machine.

Conclusion

Cash Deposit Machines (CDMs) have emerged as a vital innovation in the banking and finance industry, offering customers enhanced convenience, efficiency, and security when depositing cash. With their round-the-clock availability, real-time updates, and reduced reliance on manual processes, CDMs have transformed how customers interact with their banks. As technology continues to evolve, we can expect further advancements in CDMs, leading to even more seamless and convenient banking experiences for customers worldwide.

BOOK A FREE DEMO