If you are someone who makes regular visits to the bank, then you must know how frustrating it can get when there are long queues at the counter, you have to fill out complicated forms to make cash deposits, or when there are no employees available to answer your questions promptly.

Customer experience, or CX, is key to ensuring the success of banks. A smooth customer experience in the banking industry means that customers have a positive overall perception of the bank after they have interacted with its services at all the touchpoints.

This includes digital interactions, such as using the bank’s mobile app or asking a query online, as well as physical interactions in which customers use the services available on-site.

Most banks do not give CX the attention that it deserves because they fail to understand the impact it can have on their overall performance and revenue. The reason why developing a good customer experience can be such a game-changer in the banking industry is that it plays a crucial role in developing customer loyalty, expanding growth, and increasing the bank’s overall earnings.

When customers are satisfied with the quality of a bank’s services, they are more likely to make repeat visits, open their accounts there and ultimately develop loyalty towards it.

Moreover, they tell other people about their own experiences, which encourages them to try it out for themselves. This helps increase the bank’s customer base. Both the ability to retain customers and the growth of the bank’s clientele result in increased overall revenue. In fact, reports suggest that banks that prioritize customer experience have the potential of earning 55% more revenue.

If you are planning on opening up a new bank or are currently running one and are struggling to keep your customers satisfied, investing your time, effort, and money in developing a good customer experience is the key to your success.

In this blog, we will show you some of the best strategies to improve your customer experience and help you understand how CX can transform the banking industry by helping it grow and operate more efficiently.

Overview of the Current State of Customer Experience in Banking

Before we jump into the strategies for developing a better customer experience, let’s first look at the current state of the banking industry as well as some of the pain points that hinder customer satisfaction.

Amidst today’s state of affairs, only 20% of banks invest in customer service. The others continue to run using traditional methods, which result in inefficiency and, ultimately, negative customer satisfaction. There are two main reasons for this.

The first is that some banks still have the mindset that as long as they have a big setup and a strong enough monetary base to keep them going, customers will keep relying on them for their financial needs. This means that they don’t have to make an effort to retain customers by investing their time and money in the development of a good customer experience.

The other reason why such a small number of banks are prioritizing CX is because of the recession in the worldwide economy as a result of which there are lower budgets and an increasing struggle to meet customer expectations and keep the bank operations functioning so that it does not default.

Operating on the basis of traditional methods means that customers, even today, have pain points at different touch points in their banking experience. Some of these include long waiting/response times due to a lack of queue management, the inability of employees to find documents quickly, and the slow account opening and cash deposit/withdrawal procedures.

In addition to this, customers are increasingly fearful of the security of their financial information in banks due to the increased number of cybercrimes. A lack of investments by the banking industry in cybersecurity means that customers are dissatisfied and have a poor experience.

Around 93% of the banks in the financial services industry now admit that developing CX is crucial in determining which bank will be successful in the long run and which bank will not be able to continue its operations. As a result, many banks have slowly started moving towards the digitization of their services and have started introducing newer banking methods that are quicker, more efficient, and leave their customers satisfied.

This global shift towards the use of new technology in the banking industry is improving CX and setting a new standard that ensures convenience and is able to keep up with the fast-paced world that we live in today.

How Digital Solutions are Changing the Customer Experience in Banking

With the development of cutting-edge technologies and the increasing global shift towards digitization, the banking industry is also trying to keep up by employing digital means of providing their services and, in doing so, ensuring customer satisfaction.

Research suggests that around 58% of customers prefer digital banking services. In accordance with this, banks have started to resolve many of their customer’s pain points, including complex onboarding procedures, tedious cash deposit/withdrawal and loan requesting processes, and long waiting times – both online and on-site.

For instance, the use of mobile apps and websites provides digital onboarding for new customers, allows for transactions to be carried out online, and enables customers to clear their queries or file complaints by accessing online forms.

Virtual assistance through video chats, live chats, and Chatbots have also revolutionized banking. Customers can now get many of their issues sorted out online without visiting the branch in person. This not only helps save time from their busy schedules but also reduces customer traffic on-site which in turn prevents chaos and the dissatisfaction of those customers who prefer to visit the branch.

Digital solutions for security have also been impacting customer experience in the banking industry. With their financial information at risk of being leaked due to breaches in security, customers often show hesitation in entrusting banks with their monetary assets.

Now, with the use of digital security checks on-site along with various cybersecurity measures to ensure the protection of sensitive data, customers’ trust in banks is beginning to redevelop, leaving them more satisfied with the services that they are being offered.

Understanding the Banking Customer Journey

Perhaps the first step that all banks looking to improve their customer experience must follow is to understand their customers’ journey. A customer journey in the banking industry refers to the interactions that a customer has with the bank’s services, both digital or on-site.

Banks provide a variety of services to their customers, some of which include account and locker services, loan and mortgage services and credit/debit card services. Therefore, there are multiple possible customer journeys within the bank depending on the service that people are looking for.

To understand this better, let us see two examples, one for someone looking to open an account in a certain bank and the other for a person looking to get a problem with their debit card fixed. In the case of opening an account, the customer journey would include realizing the need for an account, visiting the bank, waiting in line (assuming there is a line) at the help desk, being directed to the relevant office or counter, filling out a form, and so on until an account is finally registered under your name.

The customer journey for someone who owns a debit card that is not working would be completely different. They would first realize something amiss with their card, call the bank for help or register a complaint online, wait for the issue to be detected, and so on until it gets fixed. They might also have to visit the branch at some point if they want to issue a new card, for example.

The point here is that due to the many services offered by banks and the multiple ways that customers can choose to go about using these services, each customer’s journey is unique.

What banks need to understand is the importance of these customer journeys. The reason for this is that these journeys can help banks in viewing their services at each touchpoint from the customers’ perspective. This, in turn, allows them to realize what the expectations of customers are from them and what their pain points are along the course of their journey.

Once banks are able to put themselves in the customers’ shoes, they can gain a better understanding of all the issues that are preventing a smooth customer experience and can take measures to address all the pain points accordingly. When banks study their customer journeys in detail, they may realize that they have been overlooking certain important aspects of their operations or have been focussing on solving the wrong problems.

Moreover, a better understanding of their customer’s journey enables them to provide customers with personalized services and may even allow them to anticipate future issues that might arrive and take the necessary steps to deal with them promptly. This will not only ensure a smooth CX over a long period of time but also gives them an edge over other competitors.

The best way to understand customer journeys is by drawing up journey maps that trace all the possible customer journeys from the very beginning, i.e., when they feel the need for a bank service, to the very end when their task has been completed.

Implementing Digital Solutions for Banking

Perhaps the most impactful means of making operations in the banking industry more efficient and enhancing the quality of customer experience is through implementing digital solutions to address customers’ pain points.

As we have discussed above, digitizing the services banks provide can revolutionize the industry as it will enable them to keep up with the fast-paced, technologically reliant world. This will, in turn, increase customer satisfaction and ultimately allow for growth and greater revenue.

- Online Appointment Scheduling

- Enterprise Queue Management and Digital Signage

- Self-Service Kiosks

- Customer Feedback

- Leveraging Data and Analytics

- Enhancing Branch and ATM Experience

With digital solutions available to customers, bank operations will improve on-site and provide customers with smooth-functioning services online through websites and mobile apps. Furthermore, digitization will help banks reduce the long queues, online traffic, and employee unavailability that result in long wait times and frustrate customers.

Rather, they will be able to cater to more people at the same time because customers will be able to access the bank’s services from the convenience of their homes/offices without needing to visit the branch for every small financial need.

Moreover, using digital solutions will also make it easier for banks to cater to their customers’ problems more efficiently and within a short period of time. There are two ways that this can happen.

- When customers have a query, they can be assisted online through live chats, Chatbots, etc., which will provide customers with solutions that are specific to their problem, which will also make the service more personalized.

- The use of digital platforms to secure documents and other customer information will make it easier to access them in time of need. This will help address the pain point that employees spend large amounts of time locating the necessary documents by rummaging through several files while customers are waiting and getting frustrated.

Below we have listed down some of the best digital solutions that you can employ in order to improve the customer experience in banks. These include solutions to manage the customer journey flow, as well as self-service solutions that can help in quickening the pace at which the bank is able to meet its customers’ needs.

1. Online Appointment Scheduling

Online appointment scheduling can bring about a considerably large impact on customer footfall in the bank at one particular time and helps prevent large crowds from gathering inside the branch, and also reduces their wait time.

When customers book their appointments with the relevant department beforehand, they come only at the scheduled time and so do not have to wait in long lines for their turn to come. This, in turn, enables them to get their work done promptly.

2. Enterprise Queue Management and Digital Signage

Queue management solutions such as Whatsapp queuing and virtual queuing can help avoid customer dissatisfaction by allowing them to queue remotely and even run other errands till they reach the front of the queue. This helps them save time and prevents frustration from having to stand in long lines.

Digital signage in the form of LED screens can be installed in different parts of the bank and help support the queueing system by displaying the queue number to inform customers how far off they are from their turn.

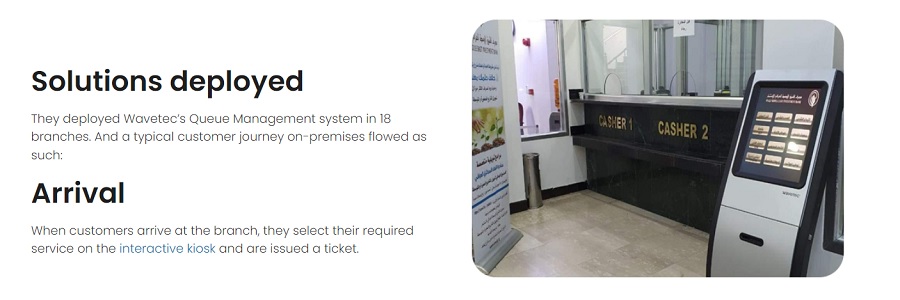

3. Self-Service Kiosks

Self-service kiosks for cash and cheque deposits, account opening, and card issuance can be game-changers in the banking industry. They can allow customers to complete their tasks on their own without needing assistance from staff members.

The installation of multiple kiosks can help cater to more customers at one time and prevent long queues from forming inside the branch. Moreover, quick cash deposits and card issuance can save a lot of customers valuable time because they will no longer have to go through tedious procedures to get their work done.

4. Customer Feedback

When it comes to banking, customer feedback is super important because it helps banks to understand how customers feel about their services and what they can do to improve.

By collecting and analyzing customer feedback, banks can identify areas where they need to improve their products and services to meet the needs of their customers. For instance, if a lot of customers complain about long waiting times when they call the customer service hotline, the bank can work on reducing wait times or improving their phone system to make it easier for customers to get through to a representative.

Customer feedback can also help banks to create better products and services that align with customer needs. If customers are asking for a particular service, the bank can develop and offer that service to meet their needs.

Another reason why customer feedback is important in banking customer experience is that it helps to build trust between the bank and its customers. When customers feel that their feedback is being heard and acted upon, they are more likely to trust the bank and continue to do business with them.

Overall, customer feedback is crucial to improving the customer experience in banking. It helps banks to understand their customers’ needs and preferences, create better products and services, and build trust and loyalty with their customers.

5. Leveraging Data and Analytics

Using available data is an excellent way to ensure a good consumer experience in the banking industry. Banks should gather the different types of data that they are dealing with, such as the regular customer footfall, the most used services, the amounts of money deposited and withdrawn, and customer reviews through feedback forms.

Once this is done, they must have data analysts study this information and determine the common trends in customer journeys, behaviors, and expectations using various analytic tools such as Power BI, Jira, Open Refine, and Datapine.

This data analysis will help reveal the pain points that customers have that lead to a negative experience. Once these issues have been identified, banks can take measures to address them and develop solutions that will ensure customer satisfaction.

It is necessary, therefore, for banks to cleverly use the data available to their advantage and open themselves up to receiving feedback from customers. It is only when banks are able to view their operations from the customers’ perspective that they will be able to develop their CX.

6. Enhancing Branch and ATM Experience

Even though online banking is becoming increasingly popular and customers are starting to rely more on the mobile apps and websites that banks have now made accessible to them, branches and ATM services still play a crucial role in the banking industry. Having multiple branches spread out over large areas is beneficial for people who prefer to avail of financial services in person. Moreover, branches are also necessary for people with physical assets inside lockers.

Even for those people who carry out most of their transactions online, branches are a necessity when they need to discuss an important matter with a bank official, have a concern that requires them to make in-person visits, or do not have the online option available to them at a particular time.

ATMs, too, play a crucial role in the banking industry as they make it easier for people to withdraw their cash on their own whenever they need to. Having ATMs in locations other banks, such as malls, petrol pumps, etc., makes it convenient for customers to access their money without having to visit the bank every time.

Given the importance of branches and ATMS in the customer journey, banks must take measures to enhance the customer experience in the context of these services. Some of the strategies that they can use in order to do this include the use of queue management solutions and digital signage like the ones mentioned above. They can also focus on employee training, increase the number of service stations inside branches, and introduce self-service kiosks for various tasks.

In terms of enhancing the ATM experience, banks can install a greater number of ATM machines to cater to more customers, invest in their maintenance, and work on improving their cybersecurity systems.

Conclusion

As with any other industry, the success of banks also relies on a smooth customer experience. In context specifically to the banking industry, good CX means that customers have a positive overall perception of the bank after they have interacted with all of its services. Developing customer experience is extremely essential for banks because it increases customer loyalty, helps expand the bank’s customer base, and ultimately results in higher revenue.

In current times, given the current state of banks where customers have a large number of pain points, good CX through the implementation of digital solutions is necessary. When customers have to wait in long lines for their turn at the counter, go through tedious procedures every time they need to open a new account, make loan requests or deposit/withdraw cash, and have to deal with the unavailability of bank staff to address their issues, they get frustrated.

This, in turn, causes negative customer satisfaction. What makes matters worse is the increasing number of cybercrimes that threaten the security of the financial information that banks have on their customers.

Digitization in banks can be extremely impactful in addressing these pain points as it can make operations more efficient and fast-paced. Employing digital solutions like queue management, digital signage, self-service kiosks, and online appointment scheduling can help save time, make account opening, card issuance, and cash/cheque deposit/withdrawal process much smoother, and can ultimately enhance customer experience.

Along with the implementation of digital solutions, what banks also need to focus on in order to develop their CX is understanding their customers’ journeys, gathering customer feedback, analyzing available data, and developing their overall branch and ATM experience. These measures can help banks go a long way in satisfying their customers and operating successfully.