Historically, self-service banking via a kiosk like an ATM has always required a bank card, such as a debit or dedicated ATM card issued by the bank. This card was used to securely verify the customer’s identity at the ATM and enable access to their account to withdraw cash or view account details.

In an increasingly digital world, financial institutions constantly innovate to provide customers with faster, more secure, and more convenient banking solutions. One such innovation gaining popularity is cardless cash deposits.

This article explores the concept of cardless cash deposits, their benefits, and how they transform how we handle transactions.

The Limitation of Physical Cards

Even newer self-service banking kiosks like cash recyclers and cash deposit machines (CDM) in many banks require a bank card to access banking services. This introduces a limitation to self-service banking as the bank card becomes a prerequisite.

This alienates a few groups, such as adult populations of developing regions where many remain unbanked or unfamiliar with advanced banking products. These people often don’t have bank cards or choose not to carry them around.

Global Chip Shortage

Another issue that has recently plagued the global banking industry is the shortage of chips due to political unrest. These chips are used in all EMV cards that banks and other financial institutions supply.

This means there is a limited supply of bank cards, and running out of these cards is a genuine possibility.

What If ATM Cards Go Extinct?

What happens when no new cards can be issued? All cards have an expiry date, and when no more can be produced, how will people get access to their money? When your debit card gets stolen, what then? We must visit our nearest branch during operational hours to withdraw cash.

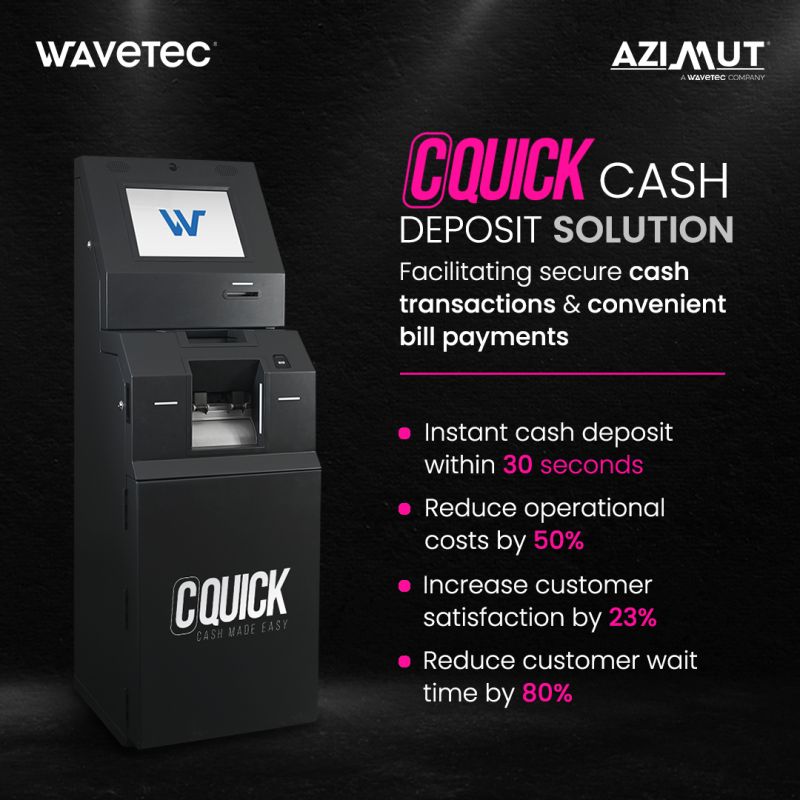

Meet CQuick, A Cardless Bulk CDM

Well, no. None of this is necessary because cardless atm self-service kiosks exist and are already deployed in many parts of the world. One example is Azimut’s CQuick, a cardless bulk cash deposit kiosk.

It Doesn’t Need An ATM Card (Deposit Money in an ATM Without a Card)

CQuick, unlike conventional ATMs or recyclers, can be used to transact without needing bank cards. You may ask how this can possibly be secure. With advanced and extensive KYC checks, CQuick is just as secure, if not more, than any other banking machine.

Check out how Wavetec helped Bank Alfalah improve operational efficiency with Azimut’s CQuick Cash Deposit.

Safe & Secure With Advanced KYC Protocols

With extended KYC capabilities, CQuick offers multiple channels to verify a customer’s identity quickly and securely. It can be connected to a country’s national identity database at the backend to verify customer identity against their ID cards, facial recognition, and liveness detection.

Alternatively, for countries where KYC mandates don’t require ID verification, a mobile OTP verification can be performed by sending a unique code to the customer’s registered mobile number.

When the correct code is entered into the CDM, the verification check is successful, and the customer may proceed to deposit cash or avail of other services.

The Future is Cardless Cash Deposit

Resources are limited, and now, more than ever, we need to realize how important it is to limit waste and think about a sustainable future. There are nearly 30 billion bank cards in circulation today, and in a few years’ time, they will expire and be in a landfill somewhere. That is a metric boatload of plastic waste, and it isn’t a one-time thing, either.

A card expires, and another is issued instantly, only to be thrown in the bin after another 5 years. The only solution to this is doing away with cards entirely and enabling alternate channels to fulfill the same needs.

For transactions, there are mobile wallets like Apple Pay, and for self-service banking & ATMs, there are cardless kiosks like CQuick.

Case Study

Prime Bank collaborated with leading technology providers to implement state-of-the-art cash deposit machines in Kenya. These machines utilize advanced security features, including biometric authentication and real-time transaction monitoring.

The CDMs were strategically deployed across key branches in Kenya, ensuring widespread accessibility for customers. User-friendly interfaces were designed to accommodate customers of all ages and technological backgrounds in the Kenyan market.

Deposits made through the CDMs in Kenya are credited to the customer’s account instantly, eliminating the need for manual processing delays.

Frequently Asked Questions

Are cardless cash deposits secure?

Yes, cardless cash deposits incorporate various security measures to protect your transactions. These measures often include encrypted codes, two-factor authentication, and secure communication channels between your mobile device and the ATM.

What happens if I enter the wrong code or encounter an error during the cardless cash deposit process?

If you encounter any issues during the transaction, such as entering the wrong code or experiencing an error, contacting your bank’s customer service immediately is recommended. They can assist you in resolving the problem and ensure that your funds are properly credited or refunded if necessary.

Conclusion

Cardless cash deposits represent a significant step forward in banking technology, offering customers a more convenient, secure, and efficient way to deposit cash. With the increasing reliance on digital platforms, this innovative solution is expected to gain wider adoption in the coming years.

As more banks embrace cardless cash deposits, customers can look forward to a more streamlined banking experience that aligns with the demands of our fast-paced, digital-centric world.

BOOK A FREE DEMO