Over the past years, banking and banking delivery is changing. This is particularly true in the case of developing countries such as Pakistan, Mexico, Kenya, etc. As banks improved their operational processes, it led to smoother banking transactions for their customers. According to the report “2018 ATM and self-service software trends”, branch employees spend about 55%-60% of their time performing customer-facing work, 20% to operational and administrative tasks and only 5% of the time is spent for prospecting new customers. Cash and cheque deposit kiosks can now help bankers to focus more on prospecting new customers. It will also help banks to transform their business by increasing productivity. Additionally, it offers customers a choice and flexibility of channel, resulting in a real-time customer experience.

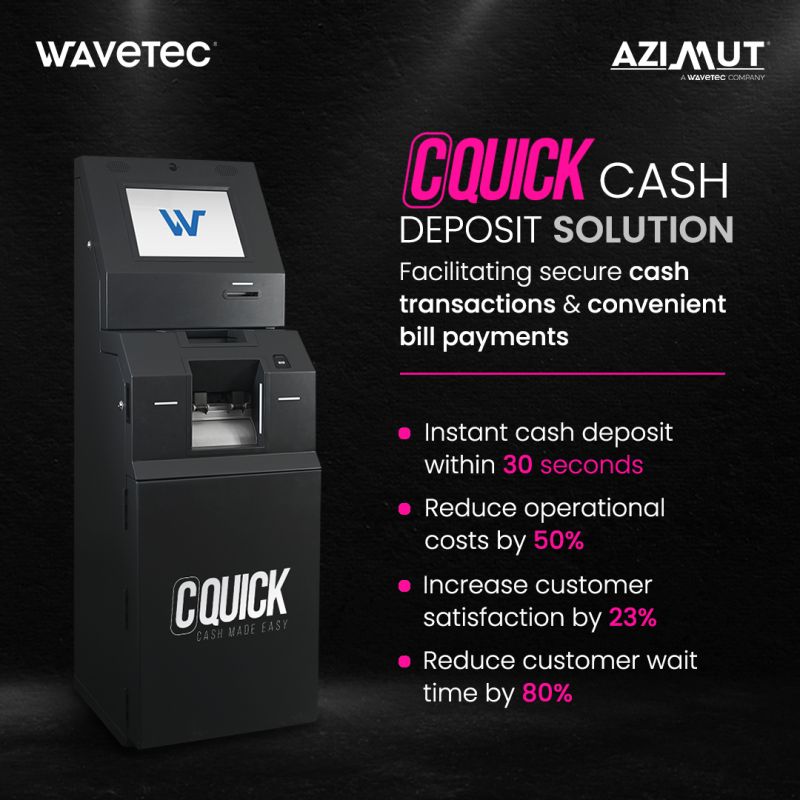

After careful analysis, it was concluded that more than 40% of banking activities are deposit transactions. Wavetec recently added a revolutionary smart solution, a Cash and Cheque deposit kiosk, to deliver exceptional customer service and value to the banking industry. Using this kiosk can increase the deposit transactions on average by 75%.

The innovative cash and cheque deposit kiosk allows customers to directly deposit cash and cheques to their bank accounts. In addition to this, the kiosk comes with the facility of the mobile wallet that helps to pay utility bills reducing the day-to-day need for cash. A one-stop facility that can be availed 24/7, eliminating the hassle of long waiting hours. This self-service solution does not only benefit the banking customers but also optimizes the banking operations.

BOOK A FREE DEMO