The banking industry was one of the first to adopt digitization in routine practices, starting with automated teller machines (ATMs). Digital transformation in banking has become crucial for banks, enabling them to meet changing customer expectations.

Customers expect virtual operational efficiency. The increasing internet use has compelled the financial sector to adopt artificial intelligence and machine learning to stay competitive in the digital age.

Customers and banks benefit from digitization. Improved risk management helps banks unlock new revenue streams and build stronger customer relationships.

In this blog, we discuss the best digital transformation tips in the banking sector with the following examples:

- Establishing a digital culture

- Enhancing customer experience

- Leveraging data and analytics

- Embracing emerging technologies

- Strengthening cybersecurity measures

- Regulatory and compliance considerations

- Change management and employee resistance

- Ticketless WhatsApp Queuing System

Statistics and Data

Here are a few numbers to help you understand digitization in the banking industry:

- According to Statista, digital banking users in the United States are expected to grow from 197 million users in March 2021 to almost 217 million by 2025.

- A Statista Consumer Insight from 2022 reported that when asked about “Mobile payments by the situation“, most U.S. respondents picked “I would like to pay with my smartphone all the time” as an answer.

What Is Digital Transformation In Banking?

Digital transformation in banking refers to the comprehensive process of adopting and integrating digital technologies, strategies, and practices to change the way a bank operates fundamentally, serves its customers, and manages its internal processes.

It encompasses a wide range of changes, from upgrading legacy systems to adopting innovative technologies and rethinking the entire customer experience.

Why is Digital Transformation in Banking Crucial For Financial Institutions?

With the financial world relying entirely on digitization, it would only be fair for you to begin your bank’s transformation journey if you wish to stay in the market. Customers are looking for convenience in managing accounts and transactions to save time.

Financial institutions deal with huge data sets, and a manual data entry error can throw off the balance sheet. It becomes crucial for the financial industry to use artificial intelligence and machine learning to boost productivity, retain marketing shares and invest in blockchain.

8 Strategies for Successful Digital Transformation for Banking Sector

- Establishing a digital culture

- Enhancing customer experience

- Leveraging data and analytics

- Ticketless WhatsApp Queuing System

- Embracing emerging technologies

- Strengthening Cyber Security Measures

- Regulatory and compliance considerations

- Change management and employee resistance

1. Establishing a Digital Culture

-

Leadership Commitment and Vision

A successful banking digital transformation strategy is governed by a strong leadership commitment to improving the work culture. All banks are required to have a digital agenda that allows the necessary organizational changes. Employees will embrace the changes and align their efforts if leaders demonstrate a vision and commitment to digital transformation.

-

Employee Training and Upskilling

Digital transformation is new to many banks. Therefore, empowering employees with digital skills and knowledge is the first step in changing the banking sector. This can be done by introducing comprehensive training programs and upskilling initiatives.

Digital literacy about the blockchain, artificial intelligence and mobile banking enables employees to adapt to new technologies. By fostering a continuous learning culture, organizations can ensure their workforce remains agile and can drive digital initiatives.

-

Collaboration and Cross-Functional Teams

Digital banking is not a one-person represent-all venture. Collaboration is key in establishing cross-functional teams that unite individuals from various departments to work towards the same goal.

A team encouraging collaboration can leverage diverse expertise to identify opportunities, solve challenges, and implement effective digital branch transformation solutions. This helps to break down the walls between members and encourages teamwork.

2. Enhancing Customer Experience

-

Omni-Channel Banking

With the rise of digital technologies, customers want a seamless experience across multiple channels that can be connected to their phones. Omni-channel banking integrates various touchpoints, such as mobile banking apps, websites, and social media.

The greatest benefit of omni-channel banking is the ability to avail the digital experience at the physical branches. This strategy enables customers to access and switch between banking services conveniently. This ensures a consistent interaction of customers with the bank regardless of the channel they choose.

-

Personalization and Targeted Marketing

Don’t we all appreciate a personalized experience from our favourite chains? The same applies to receiving tailored preferences in the digital era. Banks can segment their customer base and introduce targeted marketing campaigns.

This can be done by leveraging customer data and advanced analytics to analyze consumer behaviour. With this, you can send personalized product recommendations, relevant offers, and customized communication. This deepens customer engagement, builds trust, and improves customer satisfaction.

-

Streamlined Onboarding and Account Opening Processes

A customer’s journey with a bank starts with onboarding and account opening. The first engagement with the bank should be a simplified process and streamlined for customers to follow.

Opening a bank account is a hassle for customers, requiring them to bring multiple documents and pay repeated visits. With digital banking, you can introduce user-friendly account opening procedures. This virtual experience reduces paperwork, eliminates manual processes and keeps the bank competitive.

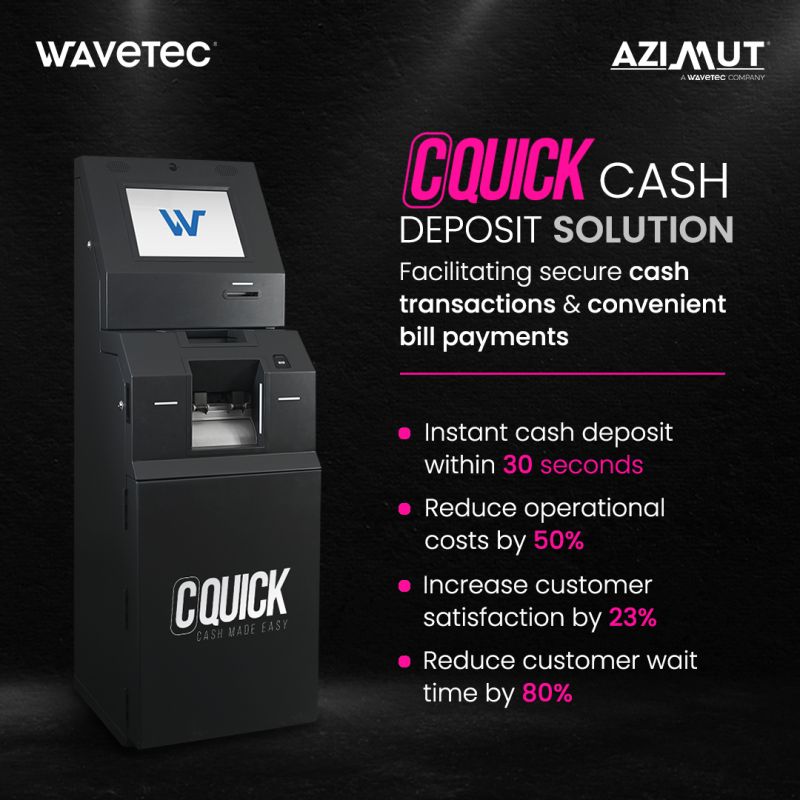

3. Ticketless WhatsApp Queuing System

With Wavetec’s WhatsApp Queuing Solution, customers can join a virtual queue by simply sending a message on WhatsApp. They receive an automated response confirming their registration and providing them with relevant information such as estimated wait time and queue position.

This solution improves customer experience by eliminating the need to wait in line physically and enhances operational efficiency for the bank. With this, banks can revolutionize the queuing experience with limited resources and effectively manage customer flow.

4. Leveraging Data and Analytics

-

Data-Driven Decision Making

Digital bank branch transformation can progress with the available abundance of data available. Banks can analyze customer behavior, transactional data, and market trends.

Data-driven decision-making allows banks to derive growth areas and pain points from the trends, optimize operations, and drive growth. This gives banks valuable insights to improve their services to customers.

-

Predictive Analytics for Customer Behavior and Risk Assessment

Predictive analytics is based on advanced algorithms modelled to analyze historical data and predict future outcomes. These can help the banking sector understand customers’ expectations of the bank.

For the bank, predictive analytics is beneficial for risk assessment, such as identifying potential fraudulent activities and assessing creditworthiness. A customer’s major worry with banks is theft and security. This helps make proactive decisions and offers a secure transactional experience to their customers.

-

Fraud Detection and Prevention

As the banking sector increasingly moves towards digital platforms, the risk of fraud also escalates. Banks can strengthen fraud detection and prevention mechanisms by monitoring transactions and applying real-time analytics. This ensures the security of the customers’ assets and maintains trust.

5. Embracing Emerging Technologies

-

Ai-Powered Chatbots and Virtual Assistants

If you want to inquire about a transaction, would you rather wait in long queues and navigate complex phone menus on call or toggle the bank’s website for a friendly chatbot?

Chatbots with virtual assistants offer 24/7 customer service, particularly important to the banking industry.

The addition of AI-powered chatbots to banking websites has greatly assisted customers. The chatbots not just understand your query but can also retrieve your transaction details instantly and provides you with a personalized response.

-

Robotic Process Automation (RPA)

We know bank employees must carry out numerous manual and repetitive tasks, such as data entry, loan application processing, or account reconciliation. This hinders the employees’ productivity and leaves little room for growth.

Bank can automate mundane tasks by implementing Robotic Process Automation (RPA). Software robots can handle data entry, validate information, and generate reports. This allows employees to focus on more complex and value-added activities.

RPA remains a one of its kind digitization to banking which has increased operational efficiency and accelerated process completion, resulting in improved customer experiences.

-

Blockchain Technology for Secure Transactions

Consider a customer who wants to make a cross-border payment. Traditional methods would require complex verification procedures taking up significant time.

Blockchain technology streamlines the transaction process by eliminating intermediaries and providing secure transactions. Moreover, it records every transaction step to prevent it from being tampered with, reducing fraud risks and increasing trust.

6. Strengthening Cyber Security Measures

-

Multi-Factor Authentication and Biometrics

Multi-factor authentication adds an extra layer of security by requiring users to provide multiple forms of identification. This saves an unusual login attempt.

For example, a customer will have to enter a password, fingerprint scan, or a one-time verification code sent to their mobile device. This way, even if someone obtains the password, they still need the additional factor to gain access.

-

Continuous Monitoring and Threat Detection

It is important to constantly monitor network activities, detect potential threats, and respond swiftly. Banks can employ advanced threat detection tools to identify suspicious activities, such as unauthorized access.

For instance, if an account shows signs of being compromised, the system can automatically trigger alerts to the customers. It can also temporarily suspend account access until the issue is resolved.

-

Data Encryption and Secure Data Storage

Encrypting sensitive data ensures that even if it is intercepted, it remains unreadable and unusable to unauthorized individuals. Banks can utilize encryption technologies to safeguard customer information, transaction records, and other critical data.

Additionally, banks should secure data storage practices utilizing robust firewalls, access controls, and regular data backups. This helps prevent data breaches and ensure quick recovery in case of incidents.

7. Regulatory and Compliance Considerations

Let’s say a traditional bank that wants to embark on a digital transformation journey. As part of the strategy, you need to address regulatory and compliance requirements.

-

Data Privacy and Protection Regulations

The bank must comply with relevant data privacy laws with the increasing use of digital channels and customer data collection. They must implement robust security measures to protect customer information from unauthorized access or breaches.

For instance, they might invest in encryption technologies, conduct regular security audits, and establish strict access controls to safeguard customer data.

-

Compliance With Know Your Customer (KYC) And Anti-money Laundering (AML) Requirements

Compliance with Know Your Customer (KYC) and Anti-Money Laundering (AML) requirements regulates prevent fraud, identity theft, and money laundering activities. The bank must implement advanced identity verification processes and transaction monitoring systems.

Employing biometric authentication methods, such as facial recognition or fingerprint scans, authenticates customer identities. They could utilize sophisticated algorithms to analyze customer transactions in real-time, flagging any suspicious activities that require further investigation.

8. Change Management and Employee Resistance

-

Communicating the Benefits of Digital Transformation

One effective strategy for bringing change is communicating digital transformation’s benefits to employees. If a bank plans to introduce a new digital banking platform for customers, the management team should communicate with employees beforehand.

By highlighting the advantages, employees are more likely to embrace the change. It makes the shift for customers easier, with minimal resistance.

-

Employee Engagement and Involvement in the Transformation Process

Another important strategy banks can adopt is promoting employee engagement. Valuing your employees and making them feel included, helping them change and actively contributing to the transformation efforts.

Let’s say a bank is implementing a new customer relationship management system. Instead of imposing the system without involving employees, the management can organize training sessions, seek feedback, and make them a part of the decision-making process.

5 Examples Of Digital Transformation In Banking

1. Mobile Banking Apps

Virtually all banks now offer mobile banking apps that allow customers to check account balances, transfer money, pay bills, and even deposit checks using their smartphones. These apps have become a standard part of modern banking.

2. Online Account Opening

Many banks have streamlined the account opening process, allowing customers to open new accounts entirely online. This involves digital identity verification and e-signatures, eliminating the need for in-person visits to a branch.

3. AI-Powered Chatbots

Banks use AI-powered chatbots on their websites and in mobile apps to provide instant customer support and answer common queries. These chatbots can handle routine tasks and free up human agents for more complex issues.

4. Robotic Process Automation (RPA)

Banks use RPA to automate repetitive, rule-based tasks such as data entry, account reconciliation, and transaction processing. This improves efficiency and reduces errors.

5. Data Analytics for Personalization

Banks leverage data analytics and machine learning to analyze customer data and offer personalized product recommendations and financial advice. This personalization enhances the customer experience.

Case Studies: Successful Digital Transformation in Banks

HSBC Mexico Implements Wavetec’s Queue Management Solution

One of the key challenges HSBC Mexico faced was ensuring a seamless customer journey across multiple touchpoints in a bank environment. HSBC Mexico successfully integrated queue management solutions, such as online banking, mobile application, and digital signage.

Customers could schedule appointments and join a virtual queue solution, minimizing physical visits to the bank and saving time. With organized lines, customers could devote more time to understanding the services offered by the bank. Embrace the efficiency of a virtual queue solution for a seamless and customer-friendly banking experience.

UBL partners with Wavetec for Digital Transformation

UBL recognized the need to adapt to the digital era and promote a customer-centric approach. By partnering with Wavetec for a queue management system and customer feedback solutions, UBL was able to transform the consumer journey.

It not only helped them optimize seating space for customers but could translate customer visits into deposits. The live reporting and analytics dashboard gave UBL insights into customer preferences, streamlining a targeted marketing campaign.

Conclusion

The journey toward banking’s digital transformation success in the modern era requires a strategic approach. The 8 major steps outlined in this blog will help banks unlock the full potential of digital innovation.

Staying ahead in the ever-evolving industry requires navigating the digital landscape. Position your bank for long-term success with a commitment to leadership, employee empowerment and a customer-centric mindset.

Are you ready to embrace the digital revolution and seize the opportunities it presents?

What are you waiting for?

Book a demo today and take your first step to digital transformation!

BOOK A FREE DEMO