Are long waiting times and customer frustration something your banking branch cannot afford?

Queue Management Systems (QMS) are technology-driven solutions that optimize customer flow and enhance service efficiency in various sectors, specifically banks.

They play a crucial role in managing queues effectively and improving customer experiences.

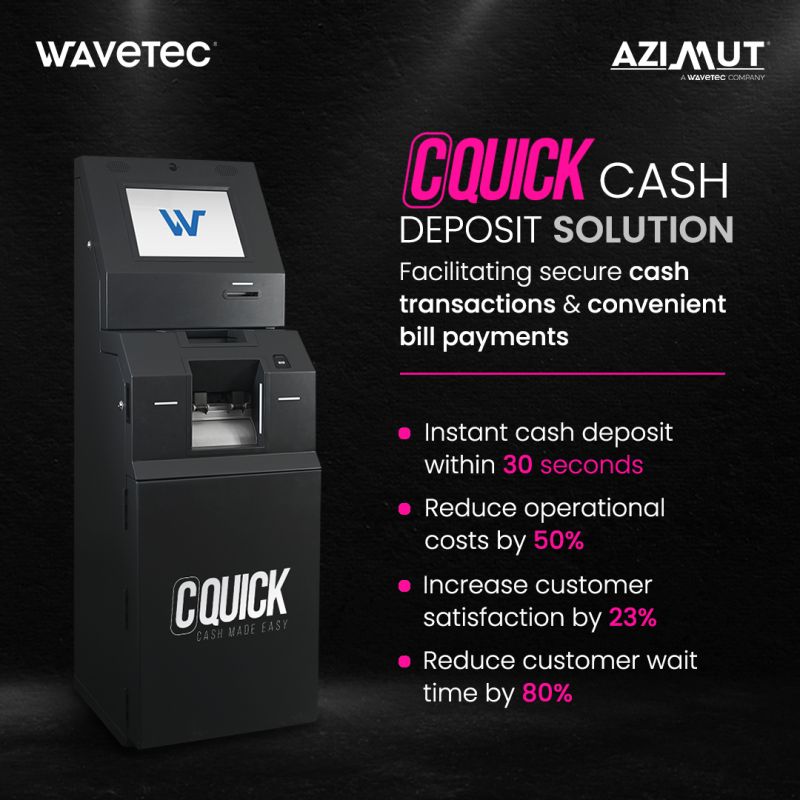

A queue management system in banks includes self-service kiosks strategically placed within the branch. These kiosks can also function as cash-deposit machines to perform routine transactions such as balance inquiries, fund transfers, or check deposits.

Research said that 73% of customers would abandon an interaction if they had to wait for more than 5 minutes in a queue. Thus, a queue management system reduces wait times and empowers customers with self-service options.

In this blog, we explore the following topics related to queue management:

- Challenges of queues in banks with a traditional system

- How the queue management system works

- Benefits of a queue management system

- Features of a queue management system

Let’s get started!

Challenges in Traditional Bank Queuing Systems

Although traditional queuing methods have been the go-to options at banks for customers, it is time for an upgrade. Traditional bank queuing has some shortfalls. Let’s look at each in detail:

1. Long Waiting Times

One of the arrangements in banks is for everyone to wait in a single line; a person leaves the line each time a service point opens up. This leads to a longer waiting time and a poor customer experience.

Long queues in banks create a false perception of poor quality of service in banks. It not only decreases engagement but reduces any chances of potential clients.

From a bank manager’s point of view, traditional queuing is a cumbersome task for staff members. Staff can be overwhelmed with improper resource allocation due to increased turnover during peak hours.

2. Customer Frustration and Dissatisfaction

Mismanagement and unorganized queuing contribute to high levels of customer dissatisfaction. When customers have to wait in long queues, it makes them rethink their decision to choose your bank for business.

The lack of transparency between the client and the bank leads to unclear communication. Often, customers are not informed of the delays in queues. So, when they reach the bank branch to find this out, it adds to their frustration.

3. Inefficient Resource Allocation

As a result of overcrowding at the bank facility it makes it difficult to distribute or utilize the available resources to their maximum potential. Inefficient resource allocation can pertain to issues related to staff allocation and space.

This means that there can be insufficient allocation of staff members at various counters. It can result in imbalanced workloads and longer waiting times for customers.

Similarly, inadequate distribution of resources can cause some teller windows to be overcrowded while others remain idle.

Improper use of space at the facility creates discomfort for clients. There is no specific area for waiting, ultimately leading to massive queues.

4. Lack of Real-Time Insights

Traditional queuing does not have advanced software that collects real-time data on customers. This limitation hinders gaining immediate insights into customer flow, waiting times, and service performance.

Without these analytics, it becomes challenging for banks to make data-driven decisions and offer customers their preferred services to add to the overall customer experience.

Benefits of Implementing Bank Queue Management System

The queue management system analyzes real-time data and identifies the appropriate staff member with the required skills to handle the customer’s request.

Improved Customer Experience

1. Reduced Waiting Times

Implementing a queue management system enables efficient customer flow at the bank. Customers know the counter and representative to approach. This minimizes wait times and prevents frustration.

2. Personalized Service

Given the queue management service’s ability to collect consumer data and analyze patterns, banks are able to understand their customers better. This leads to personalized attention to customers, who receive offers related to their interests and engagement.

3. Increased Customer Satisfaction

The branch queue management system significantly boosts overall customer satisfaction by offering efficient service and reducing customer frustration. It guarantees increased loyalty and positive word-of-mouth referrals.

Enhanced Staff Productivity and Efficiency

1. Optimized Resource Allocation

A queue management system allows banks to allocate their staff resources more effectively. During peak hours, the system can automatically assign additional staff members to the counters experiencing higher customer traffic, reducing customer wait times.

2. Staff Performance Monitoring

With a queue management system, banks can track and evaluate staff performance metrics, such as average serving time and customer satisfaction ratings. This data enables managers to identify areas for improvement and provide targeted training to enhance staff efficiency.

3. Streamlined Workflow

An automated queuing process helps streamline the workflow within the bank. For instance, when customers enter the bank, they can take a virtual ticket or register their arrival through a self-service kiosk. This eliminates the need for manual ticket distribution.

Real-Time Analytics and Insights

1. Customer Behavior Analysis

Gain valuable insights into customer preferences and patterns by tracking their queueing behavior. For instance, you can identify peak hours by analyzing waiting times and allocate staff accordingly.

2. Service Performance Evaluation

Assess the efficiency of your services through data-driven metrics such as average wait times and service durations. Identify areas of delay and make informed decisions to optimize resource allocation.

3. Data-Driven Decision Making

Make informed decisions with customer feedback data. This indicates longer wait times during lunch hours, you can adjust staffing schedules or introduce self-service kiosks to expedite the process.

Features to Look for in a Queue Management System for Banking

A queue management system should be equipped with core features, making the transition from traditional to digital queuing easier.

Integration Capabilities

Ensure the queue management system seamlessly integrates with existing banking systems and infrastructure. These include core banking software, customer databases, and digital signage solutions.

Additionally, the system should sync with the bank’s customer information database. This helps display and retrieve relevant customer details during service immediately.

Multiple Service Channels

Look for a system that supports Omni-service channels. This ensures that you offer customers multiple options, such as in-person counters, self-service kiosks, and virtual queues accessible through mobile apps or online platforms.

This enables customers to choose their preferred mode of service. For instance, customers can opt for self-check-in kiosks or virtual queues via the mobile app.

Appointment Scheduling

The system should offer appointment scheduling functionality, allowing customers to book specific time slots for their banking needs. This feature ensures efficient use of resources and minimizes customer waiting time. Customers can schedule appointments for loan consultations or open new accounts.

Mobile Applications

A queue management system with a mobile app enables customers to remotely join the queue, receive real-time updates, and manage their banking appointments. Customers can use the app to check their estimated waiting time or request virtual appointments with banking advisors.

Queue Monitoring and Reporting

The system should provide comprehensive queue monitoring and reporting features for bank staff. This allows supervisors to track customer flow, monitor service times, and identify bottlenecks. For instance, real-time dashboards can display average waiting times, current queue status, and staff performance metrics.

Integration with Customer Relationship Management (CRM) Systems

Integration with CRM systems allows the queue management system to access customer profiles, transaction histories, and personalized preferences. This enables bank staff to deliver a more personalized customer experience based on past interactions.

How does the Banking Queue System work?

A queue management system for banks is designed to promote customer flow at banks. It is based on three working principles: customer interface, central processing unit, and service providers’ interface.

As the name suggests, the customer interface enables wide access to various services. These include ticket dispensers and mobile apps to join the virtual queue. It offers a convenient way for customers to book appointments.

An efficient processing unit controls the system that collects and manages customer data and integrates the technology with existing infrastructure.

Finally, the service providers’ interface allows bank staff to collect analytics and view and manage the queue. They can track real-time customer status and prioritize service requests.

Let’s understand in detail how each part of the queue management system works:

- Ticket Dispensing Kiosk

- Digital Signage

- Customer Feedback Terminals

- Staff Dashboard and Management Software

1. Ticket Dispensing Kiosk

Customers can simply approach a ticket disThe digital displays are LCD screens that provide real-time information on queue status, wait times and service availability.pensing kiosk when they arrive at a bank. Given the easy interface of the kiosks, customers can directly select the desired service and receive a numbered ticket.

Customers then receive a ticket as a virtual placeholder in the queue. The ticket dispensing kiosks are designed to provide a hassle-free experience, allowing customers to quickly obtain their tickets and skip and proceed with their banking needs.

2. Digital Signage

Once customers are served at ticket dispensers, they receive a ticket number. The number can be displayed on electronic signage via a Digital Signage Solution. The LCD screens display the queue status.

It also has an audio system to call out the ticket numbers displayed on the screen. This way, customers can keep track of their position in the queue and anticipate when it is their turn.

3. Customer Feedback Terminals

Furthermore, the bank queue management system allows for additional functionalities, such as capturing customer feedback.

Customer feedback terminals placed strategically throughout the bank premises enable customers to provide their opinions and suggestions.

Knowing what your customers expect from your bank helps in understanding consumer behavior. Customer feedback solutions can also be integrated into existing ticketing kiosks, which ask customers to rate their experience.

This valuable feedback helps the bank improve its services. Banks can reach out to their customers and address any shortcomings.

4. Staff Dashboard and Management Software

A central software, such as the Spectra Queue Management Software with a dashboard for staff management and additional tools, provides real-time visibility into customer queues. Enable the staff members to monitor and manage customer flow efficiently.

With a staff dashboard, checking employees’ availability and assigned tasks is easier. The management software facilitates seamless integration with other systems, such as ticketing systems or self-service kiosks, allowing staff to address customer needs proactively.

These tools often offer advanced analytics and reporting capabilities, It allows tracking queue lengths, identifying bottlenecks, and allocating resources accordingly.

Banks can optimize staff scheduling during peak hours and improve overall service.

Queue Management System for Bank – Case Studies

UBL Deployed Wavetec’s Remittance Kiosk – First-Ever Comprehensive Branchless Banking solution

Queue management systems play a vital role in enhancing customer experiences and optimizing operational efficiency in banks.

In this case, UBL Banking implemented Wavetec’s queue management system to improve customer journeys and reduce queue hassles. These systems employ various technologies to streamline customer flow, such as digital signage, ticketing solutions, and real-time monitoring.

By adopting such a solution, UBL Branchless Banking aimed to provide customers with a more convenient and efficient banking experience.

It allows customers to access the required services easily while the bank benefits from optimized resource allocation and improved service delivery.

BCI Bank revamps customer experience through Wavetec’s digital signage

Wavetec’s innovative Queue Management System has revolutionized customer experiences at BCI Bank. With Wavetec’s robust solution, BCI Bank has implemented a seamless customer journey from arrival to service completion.

BCI signed up for Digital Signage Solution from the Queue Management System. It intelligently assigns customers to appropriate service counters based on the numbers issued.

The digital displays are LCD screens that provide real-time information on queue status, wait times and service availability. This way, it keeps customers informed and engaged while they wait.

The intuitive self-service kiosks are connected to the digital signage boards. It ensures that data is relayed and displayed accurately to customers. It reduces any chances of confusion and frustration among teachers.

As a result of Wavetec’s Queue Management System, BCI Bank has witnessed a significant improvement in customer satisfaction scores and a boost in overall operational productivity.

Queue Management System for Bank – FAQs

Why are queue management systems important for banks?

Queue management systems are crucial for banks to enhance customer satisfaction by managing queues and reducing waiting times in banks.

How can a bank ensure a smooth implementation of a queue management system?

Banks should thoroughly plan and communicate the changes and train staff adequately. Maximize physical space for queues and gather customer feedback to refine the system.

Can virtual queuing and self-service options be implemented in banks?

Yes, kiosks can be easily installed at branches. Offering a virtual queuing solution makes the banking experience pleasant for customers.

Final Words

A well-implemented Queue Management System holds immense value for banks. It determines the efficient regulation of customer flow and governs the customer experiences

Select and invest in an ideal queue management system for the bank that offers real-time queue monitoring, digital signage for customer communication, self-service options, and data analytics for performance insights.

Delivering exceptional service to clients comes by using advanced ticketing kiosks and cash machines, virtual queuing and mobile apps, and collecting customer feedback.

Make your customers feel valued at the bank branch by prioritizing their time.

Get in touch with us today to learn about queuing strategies in banks.

BOOK A FREE DEMO