In a world where customer experience trumps all, banks have had to evolve their customer experience to keep pace with ever evolving demands. Pakistan, a largely cash economy, recorded an immense volume of manual transactions in 2018; 75.9 million cash deposits at the counter, a staggering 45.8%, out of total bank counter transactions. This translated in to a lot of customers at branches, with access to services only during limited branch operating hours. There was a clear need for service evolution. One key strategy for this evolution is the adoption of digital tools. In a market where digital banking is still in a relatively infantile stage, banks require a smart onboarding strategy to ease customers into new features.

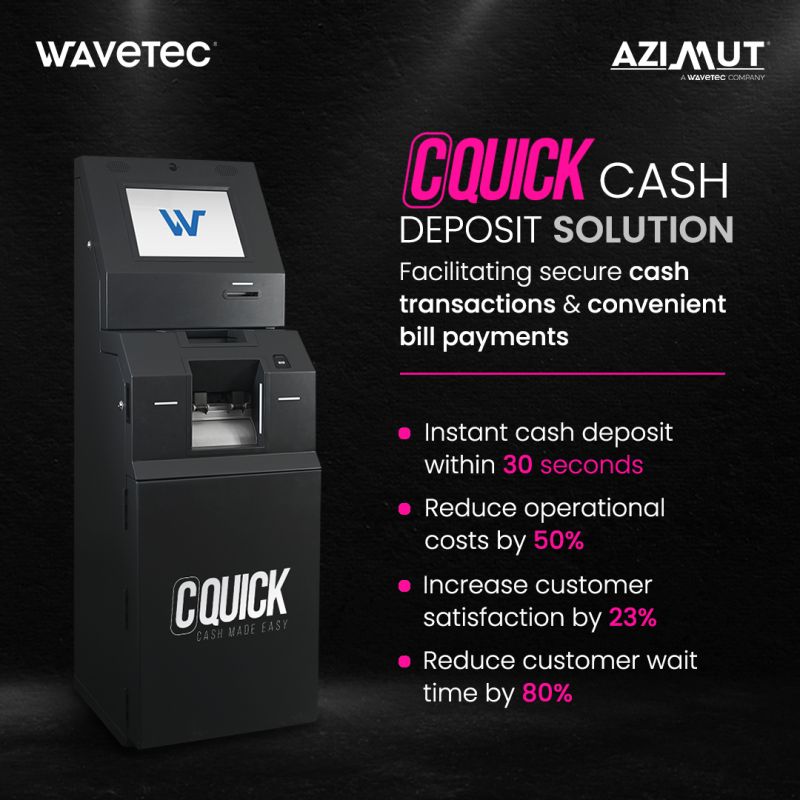

With customer engagement being at the heart of the solution, Wavetec has setup a digital cash deposit solution, in the form of self-service kiosks, at 40 locations in Bank Alfalah’s branch network. These kiosks let customers deposit cash directly to their accounts, and are integrated with Bank Alfalah’s Alpha wallet, allowing customers to pay utility bills, with ease.-1.png)

The holy grail of customer satisfaction is easier, quicker, accessible banking. Wavetec made the process more accessible and eased the burden on the bank’s counter operations. With a majority of the transactions taking place after work hours, we also managed to identify the growing need for a service like this.

Get in touch with us at sales@test.wavetec.com and one of our Consultants will get back to you to discuss the many ways in which we could help your digital transformation.