See why the world’s best brands choose Wavetec Self-Service Kiosk

What is a CDM Machine?

CDM is short for Cash Deposit Machine and performs the opposite function of an ATM or Automated Teller Machine; CDM machine accepts deposits against a customer’s bank account instead of dispensing cash from the same account.

CDMs are freestanding kiosks that may be wall-mounted as well, and they have a very similar interface and user experience to more recent iterations of the ATM.

Industry-leading Cash Deposit Kiosk for Banks & Agent Networks

Our self-service solutions digitize the branch experience, helping you support meaningful visitor experiences while meeting the demands of a new generation of clients.

Banking is evolving fast – from Fintech and Neobanks, to online channels meeting everyday financial needs. Consumers expect their banks to conduct operations as top technology brands would.

CQuick recognized and adapted to this need for digital engagement, adhering to a singular cost-efficient solution for all cash transactions. The goal is always to optimize the customer experience!

How Cash Deposit Kiosk Benefits You

80%

Reduction in customer wait times

50%

Reduction in operational cost

23%

Increase in Customer satisfaction

20%

Increase in self-service transactions

Bill Payment Kiosk

A bill payment kiosk, such as the Azimut self-service ( a cash deposit solution), offers a convenient way for customers to handle their financial transactions independently.

Powered by ViaOS software, these kiosks are part of a modern customer experience platform designed for financial institutions. ViaOS enables the development, deployment, management, and monitoring of a network of self-service units, streamlining services and ensuring user-friendly experiences.

With mobile integration, customers can quickly complete transactions by scanning a QR code, reducing the need for extensive user interaction. This technology helps automate processes, making bill payments quicker and more efficient for users.

- Dual Functionality: The cash deposit machines also function as bill payment kiosks, allowing customers to perform a variety of transactions beyond just cash deposits.

- Payment Options: The cash deposit kiosk supports diverse payment methods, ensuring flexibility for customers.

- Bill Types: Customers can settle various bill types conveniently at the CDM, including utilities, phone bills, and more.

- Accessibility: The cash deposit machine offers user-friendly interfaces and is designed for easy access by all customers, enhancing inclusivity.

- Dynamic Kiosk Software: The cash collection machine operates on adaptable kiosk software, facilitating seamless transactions and efficient management of self-service operations.

- Network Connectivity: With robust network connectivity, the cash deposit kiosk ensures reliable communication for real-time transaction processing and data management.

Components of the Cash Deposit Machine

Features of the Cash Deposit Machine

How Our Cash Deposit Solution Transformed Different Industries

[et_parent justified=”true” tab_align=”center” tab_animation=”fadeIn” color_tab_txt=”#0a0a0a” color_tab_bg=”#ffffff” color_act_txt=”#006be8″ color_act_bg=”#ebf3fd” color_hover_txt=”#006be8″ color_hover_bg=”#ebf3fd” title_font_size=”16″][et_single icon=”” tab_title=”Banking” tab_id=”1710436481110-0-6″]

Banking

Our innovative cash deposit machine has modernized banking operations, providing secure and efficient cash handling options. With features tailored to banking needs, it has streamlined deposit processes, minimized wait times, and optimized resource allocation, enhancing customer satisfaction and operational effectiveness.

Retail

Our CDM payment service has revolutionized cash management practices in the retail sector. By offering convenient cash deposit options, it has reduced reliance on traditional cash handling methods, improved cash flow management, and enhanced overall operational efficiency, improving profitability and customer service.

Telecom

Our cash deposit solution has brought about significant improvements in telecom service centers. Providing self-service cash deposit options has reduced manual cash handling efforts, minimized wait times for customers, and improved service center efficiency, resulting in a smoother customer experience and increased operative efficiency.

Government

Government agencies have experienced a transformation in cash management practices with our note deposit solution. Offering secure and convenient cash deposit options has minimized cash handling risks, improved transparency in financial transactions, and enhanced overall operational efficiency, leading to improved service delivery and public trust.

Healthcare

The healthcare sector has benefited from our bulk cash deposit machine, which has improved financial management practices. Providing secure and efficient cash deposit options has streamlined revenue collection processes, minimized cash handling errors, and enhanced financial transparency, resulting in improved financial stability and operational efficacy for healthcare facilities.

Education

Our cash deposit machine has modernized cash management practices in educational institutions. By offering secure and efficient cash deposit options tailored to educational needs, it has simplified fee collection processes, reduced administrative burdens, and improved financial transparency, resulting in improved financial management for educational institutions.

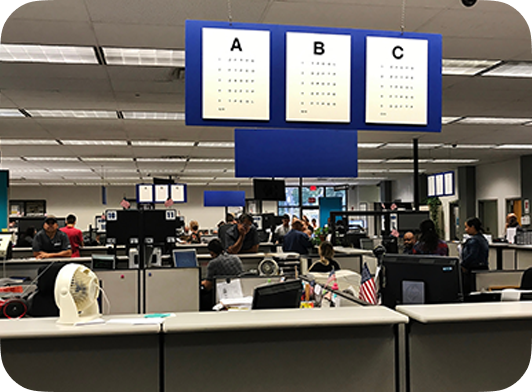

DMV

Our cash deposit solution has streamlined cash handling processes at DMV offices, improving operational efficiency and customer service. Providing secure and convenient cash deposit options has reduced manual cash handling efforts, minimized wait times for customers, and improved overall service delivery, resulting in a smoother and more efficient DMV experience.

Highlights of Brand Stories

MARS, a leading retail group, operates a chain of M&M stores across the United...

Thrive Dispensaries by MariMed Inc.

Wavetec's Queue Management Solution: The Key to a Seamless Dispensary Experience at MariMed's Thrive...

San Diego County Collaboration

The Planning & Development Services (PDS) department has introduced a fresh approach to conducting...

A Disney merchandise store located in Mall of America has opted for Wavetec’s UNO-Q...

California Public Employees’ Retirement System or CalPERS is an organization based in the United...

Delta Airlines deploys Wavetec Self Service Queue Management softwares to manage passenger traffic effectively

A behemoth of a retailer comes to terms with an unprecedented pandemic, equipped with...

ZARA, Apparel Industry leader keeping customer experience & safety a top priority

Wavetec transforms customer journey at 44 DMV stations in Tennessee with advanced virtual ticketing...

The Anatomy of a CDM (How CDM Machine Works)

Many self-service solutions providers will allow you to configure a banking kiosk that works for you and your use cases. Here, we have a standard example of a modern Cash Deposit Machine.

As standard options, CDMs will have a touchscreen interface, some form of biometric data collector, a cash vault or bag, and most importantly, a cash acceptor. Other options include a card reader, check scanner, document scanner, etc.

The most common biometric sensors on CDMs are fingerprint sensors, facial recognition, and liveness detection cameras. These sensors serve the purpose of identity verification when accessing one’s account or onboarding new customers.

Most modern self-service kiosks have large multi-touch displays to enable an easy and familiar user interface, similar to other touch-based devices like smartphones and tablets. This makes the kiosk easy for all age groups, even those unfamiliar with smartphones and tablets.

These kiosks have vaults or bags that store deposited cash, similar to ATMs. The capacities of these vaults differ and can be customized based on a financial institution’s requirements.

The cash acceptor is a CDM’s most essential and definitive module, which gives it purpose. These modules can be differentiated by their cash-in capacity, i.e., bunch or bulk. Bunch deposits are limited to 50 notes at a time, while bulk deposits can accept up to 500 notes at once.

CDMs aren’t limited to the capabilities mentioned above and can be equipped with additional modules to increase their capability exponentially:

- Cash recyclers, so they can both accept and dispense cash

- Escrow function, so cash isn’t stuck in case of an outage

- Check acceptor, to accept banker’s checks

- Document scanner to scan customer ID in case of new registration or identity verification

- Card dispenser to issue and dispense debit cards to new customers

- Card acceptor, to accept payments against bills or other transactions

Enterprise Software Solution & App Store

Open from the ground up

We have built an SDK into our machines, with open standards and open APIs. if you have existing assets in Android or Web technologies, your machines can re-use these – for agent onboarding, card or bill payment, cash management, or ERP integrations. One machine, limitless possibilities.

ViaOS – Scale with Smart Self-Service

ViaOS is a modern customer experience platform built for financial institutions to help optimize and digitize the experience. Ours is an enterprise platform designed especially to enable the development, deployment, management, and monitoring of a network of self-service units. This technology is helping banks automate and streamline their services, assuring user-friendly visitor experiences.

With mobile integration and ViaOS, customers can seamlessly complete their kiosk transactions by scanning a QR code and choosing to prestage complex transactions, reducing user interaction over time.

Smart Connect Middleware; Assessment

The Smart Connect Middleware solution allows a graphical view of the complete transactional activities of each machine. This is a single integration point for all kiosks and devices, facilitating quicker returns on investments by improving device availability efficiency and reducing the timeline for marketing new initiatives.

• Extensible platform with modules for banks, including inventory, trip management, and predictive replenishment

• Open API specification for seamless integration with existing devices

• SMS and email alert generation

• Live analytics and dashboards and the detailed, comprehensive reports they create

Frequently Asked Questions

In banking and the financial services industry, CDM stands for Cash Deposit Machine.

As opposed to an ATM that only dispenses cash, a CDM performs the opposite function, i.e., it accepts cash deposits into a specified bank account.

Depending on the manufacturer, a CDM may or may not require a CDM card to operate.

Yes, it is safe to deposit cash using the machine. Cash deposit machines are equipped with security features such as encryption and secure transaction protocols to ensure the safety of your deposits.

First, you find your bank’s CDM. Second, you insert your debit card and verify your account details. Third, you insert your desired amount of cash. Fourth, you verify the amount and that’s it, you’re done!

Wavetec Blog

Expect fresh, well-researched and industry-centric blogs, interviews and opinion pieces.

And subscribe to stay up-to-date.